The math involved in calculating how much you owe from each ‘chunk’ of income can get complicated. How do I calculate my taxes using these tax brackets? In this example, your marginal tax rate is 12%.

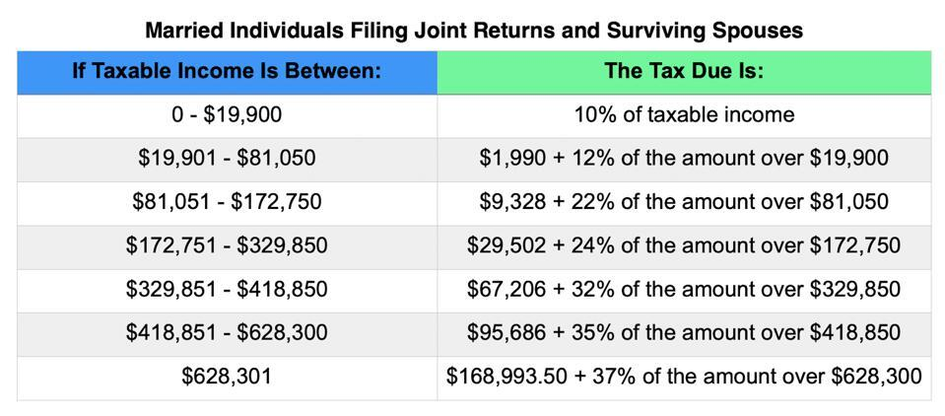

We call the highest tax rate that you pay your marginal tax rate. In equation form, we’d write this out as: So you’ll pay two different tax rates: 10% on the first $10,275 ‘chunk’ of your income, and 12% on every dollar you made above $10,275. The $0 - $10,275 bracket, which taxes you at 10% That means you’ll fall into two different tax brackets and get taxed at two different rates: This means different parts of your income is taxed at a different rate.įor example, let’s say that your taxable income ends up being $20,000. Unless you made $10,275 or less in taxable income in 2022, it’s likely you fall into at least two brackets. Let’s take the IRS tax brackets for individual single filers in 2022: Tax rate (Keep in mind, these brackets are for income tax only capital gains tax uses its own set of brackets.) Once you’ve calculated your taxable income, it’s time to look at the IRS’s tax rate schedule-a fancy term for ‘big list of tax system brackets’-for the year you’re doing your taxes for. (Check out Bench’s Big List of Small Business Tax Deductions for more info.) Tax brackets are based on your taxable income, which is what you get when you take all of the money you’ve earned and subtract all of the tax deductions you’re eligible for. Married filing jointly or qualifying widow(er) It’s broken into the four most common filing statuses: individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately: Tax rate These brackets apply to your 2022 tax filing. Here are the 2021 tax brackets according to the IRS. Which tax bracket you fall into in the United States also depends on your filing status. Income tax brackets are roughly one half that of the Married Filing Jointly income tax brackets.What are the 2021 federal income tax brackets? Jointly double from $10,275 to $20,550 at 10%, and increase far less than double from Notice, however, the Federal tax brackets for Married Filing Tax rate of 37% on taxable income over $647,850.įor the Single, Married Filing Jointly, Married Filing Separately, and Head of Householdįiling statuses, the Federal tax rates and the number of tax brackets.Tax rate of 22% on taxable income between $83,551 and $178,150.Tax rate of 12% on taxable income between $20,551 and $83,550.Tax rate of 10% on the first $20,550 of taxable income.Tax rate of 37% on taxable income over $539,900.įor married taxpayers living and working in the United States:.Tax rate of 24% on taxable income between $89,076 and $170,050.Tax rate of 22% on taxable income between $41,776 and $89,075.Tax rate of 12% on taxable income between $10,276 and $41,775.

0 kommentar(er)

0 kommentar(er)